TCO will fall, but rates will crash, too

Over the weekend, McKinsey and Company released a report detailing their view of autonomous trucking entitled “Distraction or disruption? Autonomous trucks gain ground in US logistics.” Aisha Chottani, Greg Hastings, John Murnane, and Florian Neuhaus composed the 19 page document, which laid out McKinsey’s forecast for the pace of autonomous truck development, the impact to trucking carriers’ cost structures, and implications for a number of other segments in the transportation industry, including railroad, ports, and freight brokerage.

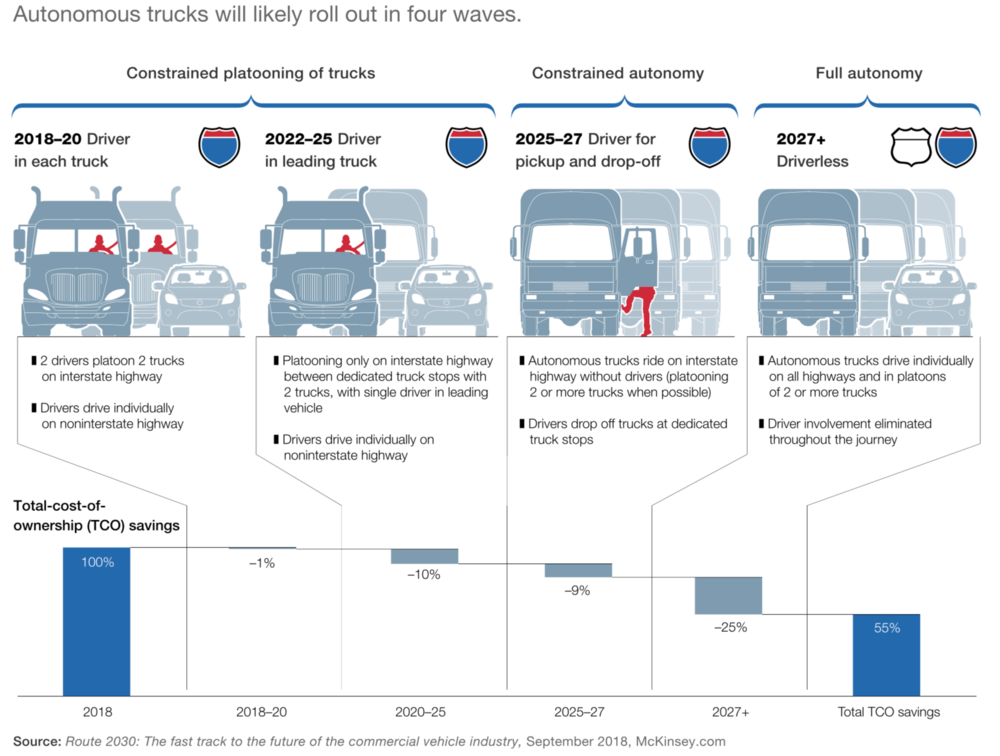

Most of the research, partially derived from a September 2018 McKinsey Center for Future Mobility report “Route 2030: the fast track to the future of the commercial vehicle industry,” is quite sound. The timeline for the introduction of fully autonomous trucks with no driver present is neither overly aggressive nor too conservative: McKinsey estimates that ‘full autonomy’ will be achieved at some point after 2027.

Some steps in the timeline, though, could have done with further research: McKinsey believes that the third phase of autonomous trucking, which requires a driver for pickup and drop-off, will occur in 2025-7. McKinsey does not cite and is apparently unaware of Starsky Robotics, which has developed a proprietary system to handle first- and final-mile trucking operations from a remote command center, similar to how Department of Defense drones are piloted. In our view, remote command-and-control is likely to replace physical drivers in ‘tricky’ driving situations before the truck is capable of operating fully autonomously.

Where the rubber hits the proverbial road is in McKinsey’s analysis of the savings in total-cost-of-ownership (TCO). McKinsey estimates that the first level of autonomy, with two drivers platooning two trucks down the road to increase fuel efficiency, represents a savings of 1% of TCO. Platooning with two trucks with only a single lead driver between dedicated truck stops on interstate highways could realize an additional 10% savings in TCO. The third phase, without drivers except for first- and final-mile, generates another 9% of savings in TCO in McKinsey’s view, and the last step, completely driverless trucks, would represent a further 25% savings. Considered cumulatively, autonomous trucks’ total cost of ownership would be 55% of conventional manually driven trucks, or, to put to another way, the technology would generate savings of 45%.

Less clear is what exactly this would mean for the industry. McKinsey notes that high-end autonomous packages might cost $100,000 per truck (representing an initial cost increase of 58% on a $170,000 truck). Realizing that the costs associated with the technology and with the data infrastructure needed to manage autonomous assets efficiently could only be borne by the largest, most well-capitalized fleets, McKinsey hints at some effects to the trucking industry without really exploring the deeper implications.

“Second, the rise of [autonomous trucks] could spur consolidation of the national fleet, which is highly fragmented today. Third, [autonomous trucks] could alleviate the industry’s capacity crunch,” McKinsey’s consultants wrote.

We think that the second effect is really a consequence of the third. A well-capitalized trucking carrier that can afford to invest in autonomous trucks will likely rapidly adopt them, because autonomous trucks will be able to run nearly 3x the mileage (according to ELD data, most trucks only have wheels rolling for about 6.5 hours each day) at just over half the cost. While autonomous trucks are still in competition with human-driven trucks, they will be money machines.

However, once most of the large, publicly-traded trucking carriers have adopted autonomous trucks, the combination of the lowered costs and the vastly increased available capacity will crash rates. Large trucking companies will battle each other for market share, seeking to fully utilize their new assets and compressing their recently expanded margins. Small trucking companies will not be able to compete on either price or cost, leading to a rapid consolidation of the industry. In my view, this transformation will begin to have dramatic effects on the trucking industry within 4-5 years of the availability of fully autonomous trucks, a similar time scale to deregulation’s impact on the industry in the 1980s.

A glut of capacity and a race to the bottom in rates will consolidate the trucking industry, eventually making it look more like maritime shipping than the trucking industry we know today. What happened to maritime shipping? In the 1960s, the rise of containerization eliminated most dock workers, drove vessel sizes larger, and commodified capacity. In the early 1980s Hapag-Lloyd operated 3,050 TEU vessels with 40 crew members, but today Maersk sails 18,340 TEU vessels with 13 crew members. These efficiencies and incentives rapidly consolidated container shipping: in 2017, the six largest lines owned 68.1% of the market. Yet these companies make barely any money: in the third quarter of 2018, Maersk brought in $10.1B of revenue but was only able to hold onto $251M in underlying profit.

In other words, autonomous trucking will not change the fundamentals of what is already a capital-intensive, low-margin industry, except for the brief period when large carriers with autonomous trucks are seizing market share while expanding their margins. Once autonomous trucks are competing with autonomous trucks, carriers’ margins will evaporate again, but even more capital will be locked up in the assets and increasingly sophisticated and highly paid professionals who manage them.